The Governance Layer

Your IT Team Can't Provide

Your MSP handles security. We handle documentation, policies, and compliance. Generate FTC & IRS compliant IRPs, WISPs, and governance frameworks in minutes—not months.

$59.99 $29.99/month · Use code FOUNDINGMEMBER

Built for Compliance

FTC Safeguards Rule

Maintain your security program governance with FTC-compliant documentation and controls.

IRS Publication 4557

Aligned with IRS data security guidelines for tax professionals

Enterprise Security

Bank-grade encryption protecting your compliance documentation

Think You're Too Small? Think Again.

FTC & IRS requirements apply to ALL tax preparers who handle client data—regardless of firm size or client count.

MYTH

"I only have 200 clients, so the FTC Safeguards Rule doesn't apply to me."

FACT

The 5,000-record threshold applies to only 2 specific requirements. Core compliance applies to ALL firms.

Requirement

Small Firms

(< 5,000 records)

Larger Firms

(5,000+ records)

Written Incident Response Plan (IRP)SafeGuardGRC Core

FTC 16 CFR 314.4(h)

Annual IRP Review & UpdatesSafeGuardGRC Core

FTC 16 CFR 314.4(h)

Written Information Security Policy (WISP)In Progress • Q2 2026

FTC 16 CFR 314.4 & IRS Pub 4557

Secure Data Disposal ProceduresIn Progress • Q2 2026

FTC 16 CFR 314.4(e)

Annual Risk Assessment

FTC 16 CFR 314.4(b)

Multi-Factor Authentication (MFA)

FTC 16 CFR 314.4(c)

Access Controls & Least Privilege

FTC 16 CFR 314.4(c)(4)

Employee Security Training

FTC 16 CFR 314.4(d)

Service Provider Oversight (Vendor Management)

FTC 16 CFR 314.4(g) & IRS Pub 4557

vCISO (Virtual Chief Information Security Officer)

FTC 16 CFR 314.4(g) & IRS Pub 4557

Annual Penetration Testing

FTC 16 CFR 314.4(f)

Risk Assessment: While a written risk assessment is not required for firms with under 5,000 records, conducting one is highly recommended. Without a risk assessment, your firm won't identify compliance gaps or understand areas requiring attention.

Qualified Individual: ALL firms must designate a qualified individual to oversee their information security program (FTC 16 CFR 314.4(a)). While a formal CISO title is not required for any firm size, larger firms with 5,000+ records face additional compliance complexity, enhanced governance documentation requirements, and ongoing oversight obligations. For these firms, engaging a virtual CISO (vCISO) or dedicated security professional is highly recommended to manage the increased scope and ensure proper governance.

How Many Requirements Are You Meeting?

Take our 30-second quiz to discover your compliance gaps.

✓ No credit card required ✓ Results in 30 seconds

Official Sources:

⚠️ Your firm size doesn't exempt you from core compliance

SafeGuardGRC helps firms of all sizes meet these requirements—from solo practitioners to multi-partner firms.

$59.99 $29.99/month with code FOUNDINGMEMBER

The Governance Gap MSPs Can't Fill

Your IT team secures your systems. But security ≠ compliance.

You need documented governance—and that's not their job.

What Your MSP Provides

- •Firewalls & network security

- •Endpoint protection

- •Backup solutions

- •Patch management

- •24/7 monitoring

✅ Technical controls (the "how")

The Missing Piece

- ✗Written incident response plans

- ✗Documented policies

- ✗Compliance frameworks

- ✗Risk assessments

- ✗Governance structure

❌ Documentation & governance (the "what" and "why")

What SafeGuardGRC Provides

- ✓FTC & IRS compliant IRPs

- ✓Written security programs (WISP)

- ✓Policy library

- ✓Risk assessment tools

- ✓Compliance dashboard

✅ The governance layer IT can't provide

Why IT Teams Don't Handle This

MSPs and IT departments focus on technical security: firewalls, patches, monitoring. But regulators want documented governance: policies, procedures, incident response plans.

That's where SafeGuardGRC comes in. We fill the governance gap with AI-powered compliance documentation that works alongside your existing security infrastructure.

FTC & IRS Now Require Written IRPs

Hiring a vCISO Costs $3,000-10,000

Most small CPA firms can't afford consultant fees for compliance documentation. That's 100+ billable hours of revenue.

DIY Templates Take Weeks

Generic templates don't account for YOUR tax software, YOUR team structure, or YOUR state's breach laws. You're left filling in blanks with no guidance.

FTC Penalties Up to $46,517 Per Violation

The FTC Safeguards Rule (16 CFR 314.4(h)) and IRS Publication 4557 aren't optional. Non-compliance risks massive fines and reputation damage.

Compliance in 10 Minutes, Not 2 Weeks

$59.99/Month - Less Than 1 Billable Hour

All-inclusive pricing. FTC & IRS compliance, version control, annual reviews, and future features (WISP, policies) included.

10-Minute Setup, AI-Powered Generation

Enter your firm details once. AI generates custom policies specific to Drake, CCH, Lacerte—whatever tax software YOU use.

Always Compliant, Automatically Updated

FTC rules change? State laws update? We update your templates automatically. Annual review reminders keep you audit-ready.

vs. hiring consultants ($3,000) - $59.99/mo = $2,940.01 first year savings

Get Compliant in 3 Simple Steps

From sign-up to compliant IRP in just 10 minutes

Set Up Firm Profile

Enter your firm details, team contacts, and tax software. Takes just 3 minutes.

Select Your Scenarios

Choose which incidents to cover: ransomware, wire fraud, lost laptops, EFIN hijacking, and more.

Generate & Download

AI generates your customized, FTC and IRS compliant IRP. Download PDF or save to Drive.

Video Demo or Screenshot Walkthrough

(Placeholder - Add actual demo)

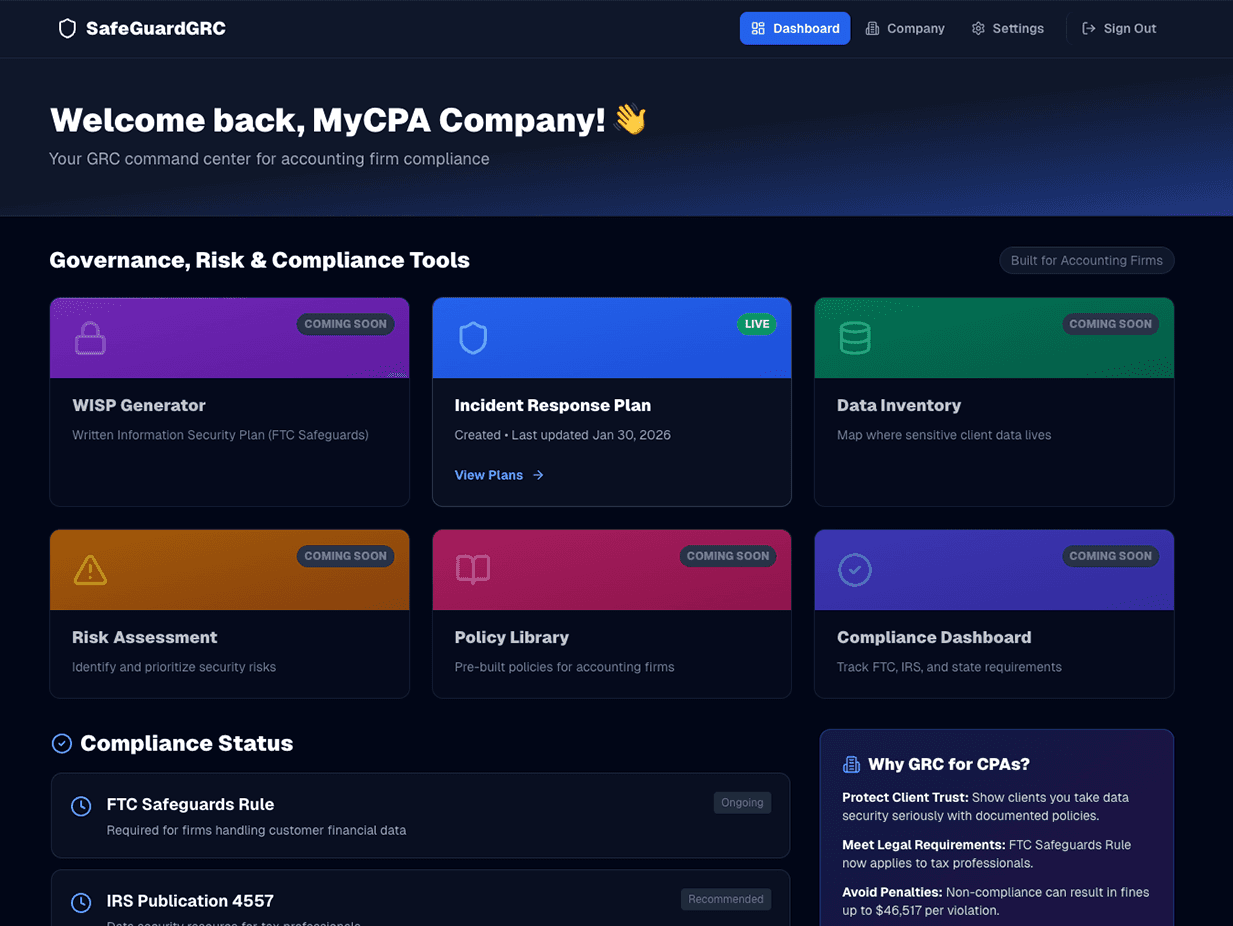

Everything You Need for Compliance

Built specifically for accounting firms. FTC & IRS compliant. Always up-to-date.

FTC & IRS Compliance

Pre-built templates aligned with FTC Safeguards Rule and IRS Publication 4557. Maintain your security program governance through appropriate documentation—without hiring consultants.

- FTC Safeguards Rule templates

- IRS Pub 4557 requirements included

- State breach law compliance matrix

Version Control & Audit Trail

Track all plan versions with complete audit history. Annual review reminders keep you FTC compliant year-round.

- Track all plan versions

- Annual review reminders

- Complete audit trail for regulators

Multi-Plan Support

Start with Incident Response Plans today. WISP Generator and Policy Library coming soon - all included in your subscription.

- Incident Response Plans (Live)

- WISP Generator (Coming Q2 2026)

- Policy Library (Coming Q3 2026)

Built Specifically for CPAs

Tax software-specific playbooks for Drake, CCH Axcess, Lacerte, and more. Scenario library covers ransomware, wire fraud, and EFIN hijacking.

- Drake, CCH, Lacerte playbooks

- Ransomware, wire fraud scenarios

- Contact tree templates

AI-Powered Generation

Our AI agent generates custom plans in plain English, not legal jargon. Plans are tailored to your firm's software stack and structure.

- Advanced AI technology

- Natural language, not legalese

- Learns from your firm setup

Always Up-to-Date

Plans automatically updated as regulations change. New scenarios added quarterly. Never worry about outdated compliance documentation.

- Regulation updates included

- New scenarios added quarterly

- Automatic compliance reminders

Why I Built SafeGuardGRC

16 years of compliance experience, countless frustrated firms, and one critical realization

Daniel Chang

Founder & CEO

Former IT Auditor, Deloitte

The Pattern I Kept Seeing

After 16 years in security compliance

I started my career at Deloitte as an IT Auditor, working with everyone from scrappy startups to Fortune 500 companies. I helped them build security controls and achieve compliance certifications across frameworks like SOC 2, ISO 27001, PCI, HIPAA, and dozens of regional regulations.

But here's what frustrated me: I kept seeing the same mistake, especially with small and medium businesses.

They'd hand everything to their IT provider and call it done.

Their MSP handled the technical security—firewalls, backups, patches. But nobody was handling governance. Nobody was documenting policies. Nobody was conducting risk assessments. Nobody was reviewing incident response plans annually.

The tone at the top was missing. And when the FTC or IRS came knocking, these firms had nothing to show.

The Firms That Got It Right

A different approach entirely

But some firms were different. The smart ones weren't treating compliance as an expense—they were using it as a sales enabler.

They'd walk into client meetings and say, "We're FTC compliant. We have documented incident response procedures. Your data is protected by enterprise-grade governance."

That changed everything. Compliance wasn't a burden—it was a competitive advantage.

I realized: this should be the standard, not the exception. But most firms didn't have the knowledge or capacity to build these programs themselves.

Why I'm Built to Solve This

The right experience at the right time

I've sat on both sides of the table—implementing compliance programs AND auditing them. I know what works efficiently and what's just checkbox theater.

Working closely with accounting and audit teams at Deloitte, I saw how they operate during busy season. I understand the time constraints. I know they can't become cybersecurity experts—that's not their business.

But here's my secret weapon: I love solving problems with code and automation.

What if we could automate what consultants charge $5,000+ for? What if we could turn a 3-month project into a 10-minute questionnaire?

That's SafeGuardGRC. 16 years of compliance expertise, automated.

Where We're Going

My goal isn't to make accountants into cyber experts. It's to give them the governance layer their IT team can't provide.

In 1-3 years, I want SafeGuardGRC to be another tool in every accounting firm's toolbox—as standard as QuickBooks or CCH. Not removing accountability from the Qualified Individual, but accelerating their decision-making and ensuring their cybersecurity posture stays compliant.

Because here's the truth: firms don't want to be compliant for compliance's sake. They want to safeguard their clients' information. They want to win business. They want to sleep well at night during busy season.

Success looks like this: Accounting firms taking control of their governance programs—confidently, efficiently, and profitably.

We're just getting started, and I'd love for you to be part of our founding cohort.

$59.99 $29.99/month · Locked in for life

Frequently Asked Questions

Everything you need to know about SafeGuardGRC

Still have questions?

Contact Support →Ready to Get Compliant?

Be among the first 100 firms to lock in 50% off for life

$59.99 $29.99/month with code FOUNDINGMEMBER

Placeholder: "100+ firms" - Update with real count when available